oregon tax payment extension

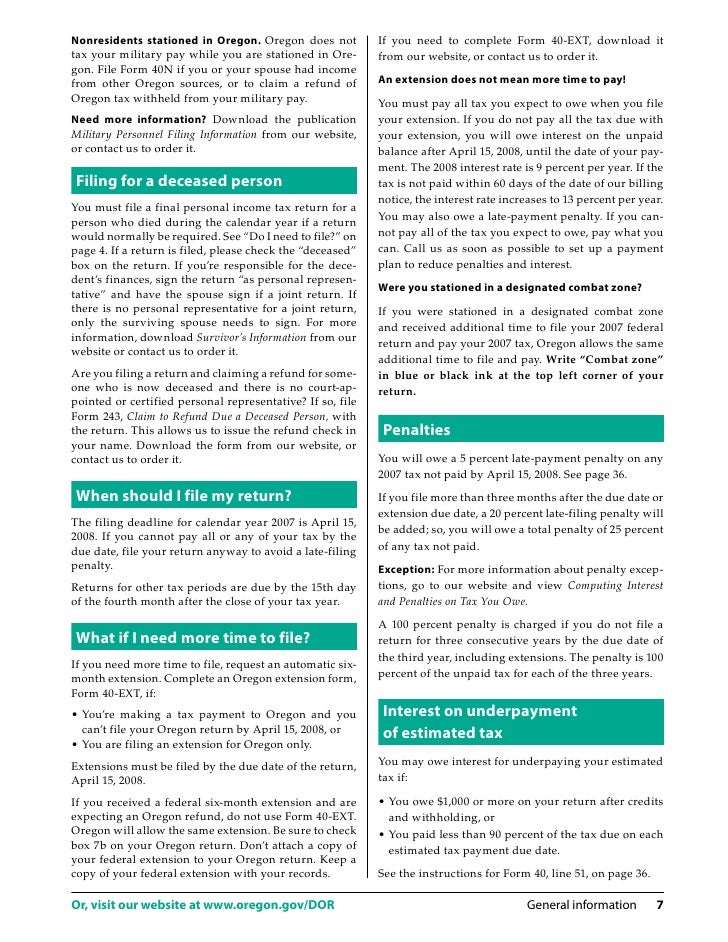

When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form. Late payments will not receive a discount and may incur interest.

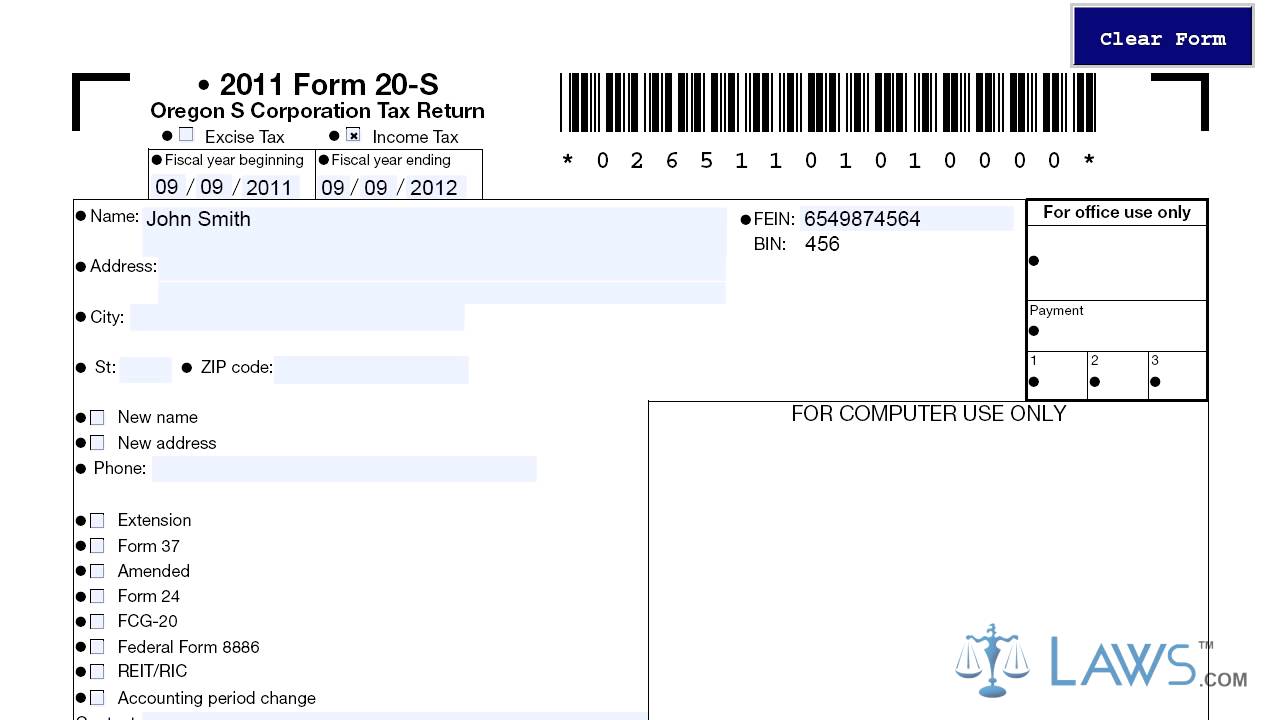

State Of Oregon Forms Forms And Publications Library

Pay any interest due when you file or.

. The Oregon return filing due date is automatically extended until July 15 2020 for any returns with a valid six-month extension period ending on or after April 1 2020 and before July 15. All Oregon residents and businesses are required to file annual City of Oregon income tax returns as well as any businesses with net profit or loss earned within the city. You dont need to request an Oregon extension unless you owe a payment of Oregon tax.

If you fax your business tax return to us but need to make a tax return. If you cannot file by that date you can get a state tax extension. Service provider fees may apply.

Federal automatic extension federal Form 4868. EFT Questions and Answers. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to.

Pay full amount by 11152022 for. Electronic payment using Revenue Online. Pay at least 90 percent of the tax due by the original due date of the return and.

Cookies are required to use this site. Businesses can file a federal Form 7004 to obtain an extension with the state of Oregon. Oregon individual income tax returns are due by April 15 in most years.

If you owe Oregon personal income tax follow the. Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 were eligible for an 850 direct relief payment. When filing an Oregon tax return for 2021 include your extension payment as an estimated payment on Form OR-40 line 34.

Penalty and Interest Charges on Tax Owed. Fax your completed business tax return s and supporting tax pages or extension request to. Choose to pay directly from your bank account or by credit card.

The 2021 tax deadline. Individual income tax return. Individuals in Oregon need to file Form OR-40-EXT with the state to get a 6-month extension of time to file their personal income tax returns Form OR-40 with the state.

Your browser appears to have cookies disabled. Extension Clerk Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950. Pay by phone or online.

Phone 800 356-4222 Online. PortlandMultnomah County Combined Business Tax Payment. Pay the balance of the tax when you file within the extension period and.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. Oregon honors all federal automatic six-month extensions of time to file individual income tax returns federal Form 4868 as valid Oregon extensions. You must pay at least 90 of your total tax liability by April.

An Oregon personal extension will give you 6 more. Or Form OR-40-P line 58. Corporate Income and Excise.

For tax years beginning on or after January 1 2021 you will use BZT-V and CES-V to make quarterly estimated payments. Payments must be submitted on or before the following due dates. There is no state-specific form to request an extension.

Be advised that this payment application has been recently updated. Those needing additional time to file beyond the May 17 deadline can request a filing extension until October 15 by filing federal Form 4868 through their tax professional or. Oregon Tax Payment System Oregon Department of Revenue.

Form OR-40-N line 59.

Unh Cooperative Extension And Oregon State University Release Timber Income Quick Reference Ahead Of Tax Filing Deadline Extension

Federal Income Tax Deadline In 2022 Smartasset

Form 20 S Oregon S Corporation Tax Return Youtube

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

How To File An Extension For Taxes Form 4868 H R Block

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

On Tax Day An Extension May Be Better Than Rushing A Return

State Of Oregon Form 41 Year 2018 Fill Out Sign Online Dochub

What Can I Do With My Small Farm Selecting An Enterprise For Small Acreages Osu Extension Catalog Oregon State University

Filing An Extension Artemis Tax

Blog Oregon Restaurant Lodging Association

Poll A Trimet Official Recently Stated That New Tax Revenue Would Be Needed From Oregon And Washington Residents To Pay For The Light Rail Extension Into Vancouver Are You Willing To Pay

Need To File Taxes You Re Ok With The Extension Oregon Community Credit Union

Free 6 Sample Income Tax Extension Forms In Pdf

Or Form Or 40 Instructions Fill Out And Sign Printable Pdf Template Signnow

Oregon Reminds That Tax Filing Deadline Is April 18 News Kdrv Com

Are Oregon Taxes Due On April 15 State Still Undecided Whether To Follow Irs Deadline Extension Oregonlive Com